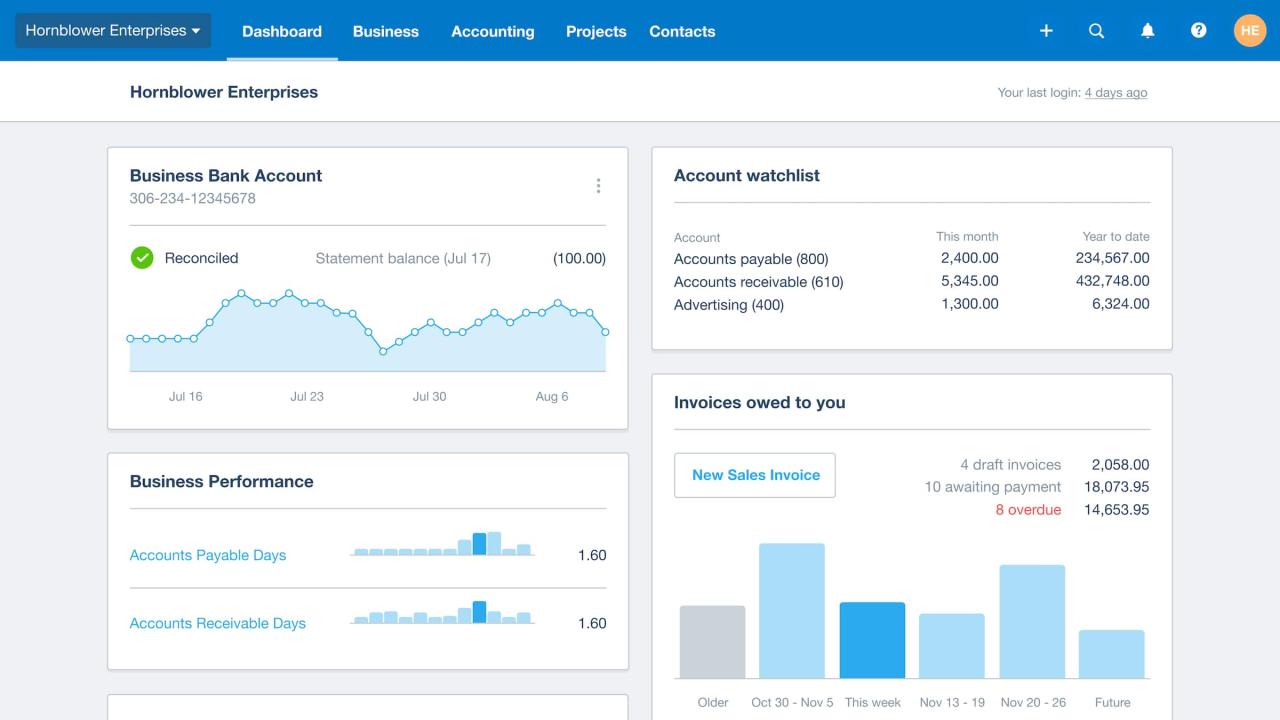

SuaraPublik – Using Xero for personal finances offers a powerful and streamlined approach to managing your money. Beyond its reputation as a business accounting software, Xero provides a user-friendly platform for individuals to track income, expenses, and investments, all in one place. This guide delves into the key features and functionalities that make Xero a valuable tool for personal finance management, exploring its ability to simplify budgeting, automate transactions, and provide insightful financial reports.

Whether you’re seeking to gain greater control over your spending, streamline your bill payments, or develop a comprehensive financial plan, Xero offers a robust set of tools designed to meet your needs. This guide will walk you through setting up your Xero account, connecting your bank accounts, creating budgets, and leveraging the platform’s powerful reporting features to gain a deeper understanding of your financial picture.

Setting Up Xero for Personal Finance: Using Xero For Personal Finances

Xero, a cloud-based accounting software, can be a valuable tool for managing your personal finances. It provides a comprehensive platform to track your income, expenses, and assets, offering features that simplify budgeting and financial planning.

Creating a Xero Account

To get started with Xero for personal finance, you need to create an account. Here’s how:

- Visit the Xero website and click on the “Sign Up” button.

- Select “Personal” as your account type.

- Enter your email address, create a password, and choose your country.

- Accept the terms and conditions and click on the “Create Account” button.

Connecting Bank Accounts and Credit Cards

Once you have a Xero account, you can connect your bank accounts and credit cards to automate transaction recording. This saves you time and effort by eliminating the need for manual entry.

- Navigate to the “Bank” section in your Xero account.

- Click on the “Add Bank Account” button.

- Select your bank from the list or search for it manually.

- Enter your online banking credentials to allow Xero to securely access your account data.

- Xero will automatically import your transactions, categorizing them based on the transaction description.

Customizing Categories and Creating Budgets

Xero allows you to customize categories and create budgets to gain better control over your finances.

- Navigate to the “Chart of Accounts” section to manage your expense and income categories.

- Click on “Add Account” to create new categories or edit existing ones.

- To create a budget, go to the “Budgets” section and click on “Add Budget.”

- Choose a budget period (monthly, quarterly, or annually) and allocate funds to different categories.

- Xero will track your spending against your budget, providing insights into your financial behavior.

Tracking Income and Expenses with Xero

Xero simplifies tracking your income and expenses, providing a clear picture of your financial health. It automatically categorizes transactions based on merchant names and descriptions, making it easy to see where your money is going. However, you can also manually categorize transactions for greater control and more detailed insights.

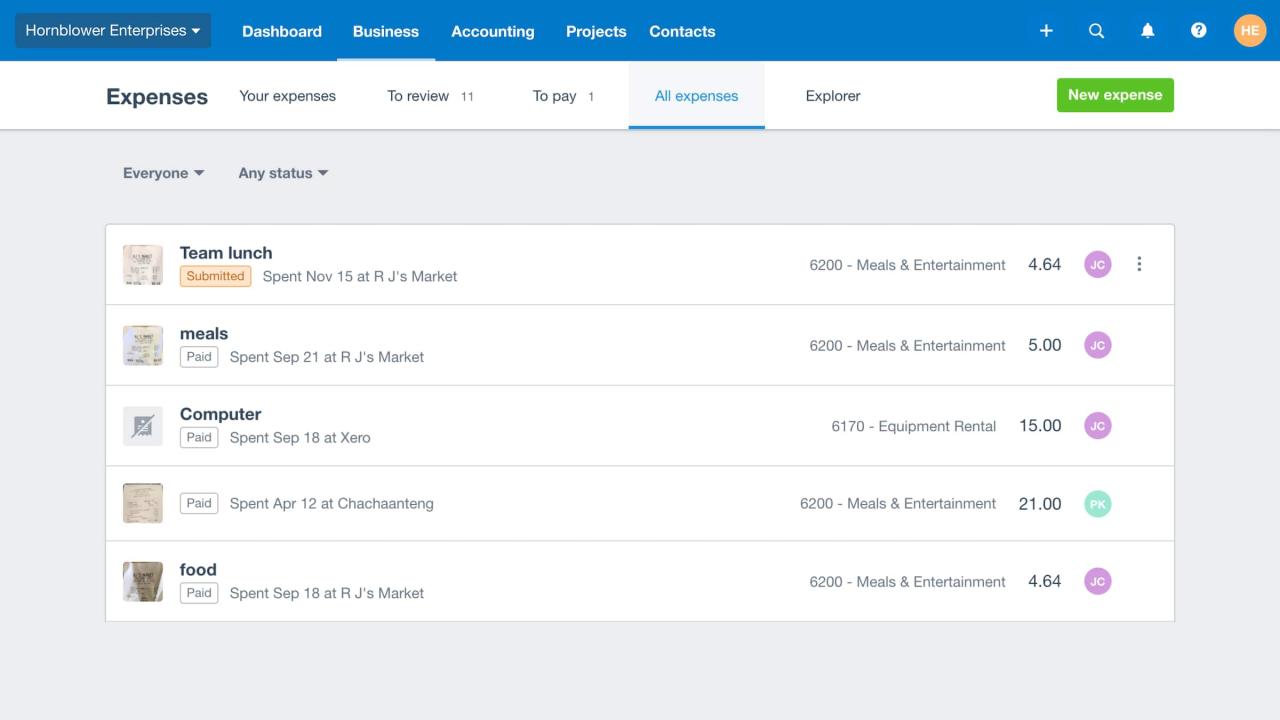

Automatic Transaction Categorization

Xero uses its intelligent technology to automatically categorize transactions based on merchant names and descriptions. This means you don’t have to manually categorize every transaction, saving you time and effort. For example, if you make a purchase at a grocery store, Xero will likely categorize it as “Food & Drink.” This feature is particularly helpful for recurring transactions, such as utility bills or subscriptions.

Manually Categorizing Transactions

While Xero’s automatic categorization is efficient, manually categorizing transactions can provide a more detailed and personalized view of your finances. This is especially important for transactions that might not be easily categorized automatically, such as transfers between accounts or payments for services. To manually categorize a transaction, simply click on the transaction in your Xero account and select the appropriate category from the dropdown menu.

Xero offers a wide range of categories, allowing you to customize your financial tracking to meet your specific needs. For example, you can categorize transactions related to your car into “Car Maintenance,” “Car Insurance,” or “Car Fuel.”

Using Xero’s Reporting Features

Xero’s reporting features are a powerful tool for analyzing your spending patterns and identifying areas for improvement. The platform offers a variety of reports, including:

- Profit and Loss Report: This report shows your income and expenses over a specific period, giving you a clear picture of your financial performance.

- Balance Sheet Report: This report provides a snapshot of your assets, liabilities, and equity at a specific point in time.

- Cash Flow Statement: This report tracks the movement of cash in and out of your business, helping you understand your liquidity position.

- Transaction List Report: This report provides a detailed list of all your transactions, including the date, amount, and category.

By analyzing these reports, you can identify trends in your spending, track your progress towards your financial goals, and make informed decisions about your finances. For example, you might notice that you are spending more than you expected on entertainment or that you are not saving enough for retirement. This information can then be used to adjust your spending habits and achieve your financial goals.

Managing Bills and Payments with Xero

Xero simplifies bill management and payment tracking, making it easy to stay on top of your personal finances. You can schedule and track bill payments, utilize Xero’s online payment functionality for recurring bills, and create invoices for personal expenses.

Scheduling and Tracking Bill Payments

Xero’s bill management features allow you to schedule and track bill payments, ensuring timely payments and avoiding late fees.

- Add Bills: You can add bills directly to Xero by entering the bill details manually or importing them from a spreadsheet or bank statement.

- Set Payment Reminders: Xero will send you email reminders before a bill’s due date, ensuring you never miss a payment.

- Track Payment History: Xero keeps a detailed record of all your bill payments, making it easy to track your payment history and reconcile your accounts.

Using Xero’s Online Payment Functionality for Recurring Bills

Xero’s online payment functionality offers a convenient way to manage recurring bills, such as rent, utilities, and subscriptions.

- Automated Payments: Set up automated payments for recurring bills, ensuring timely payments without manual intervention.

- Secure Payment Processing: Xero uses secure payment gateways, ensuring the safety of your financial information during online transactions.

- Track Payment Status: You can track the status of your online payments within Xero, ensuring transparency and control over your finances.

Creating and Managing Invoices for Personal Expenses

While invoices are often associated with businesses, Xero allows you to create and manage invoices for personal expenses, such as rent or utilities, especially when sharing expenses with roommates or housemates.

- Create Invoices: You can create invoices for personal expenses, including details like the expense type, amount, and due date.

- Send Invoices: Send invoices directly from Xero to your roommates or housemates via email, simplifying the process of requesting payment.

- Track Invoice Payments: Xero tracks invoice payments, providing a clear overview of outstanding balances and payment history.

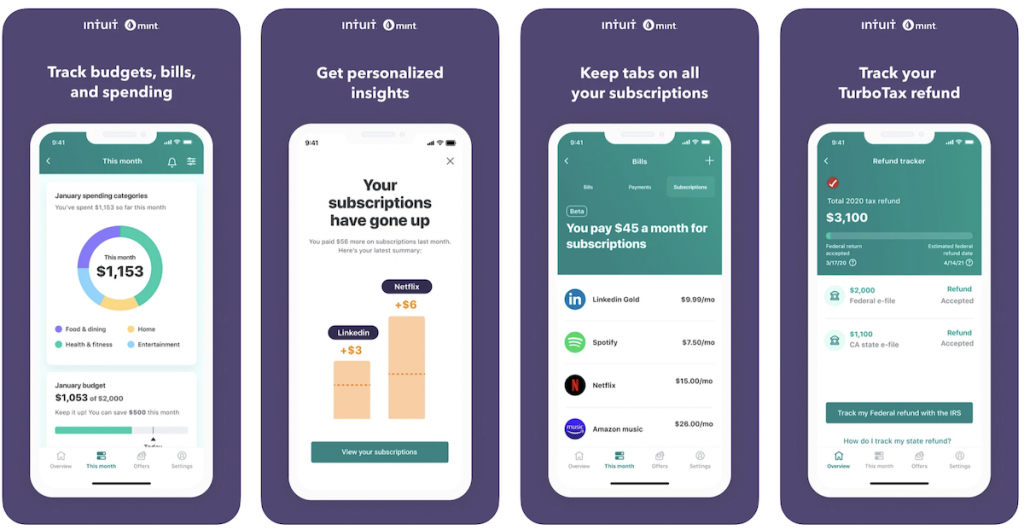

Budgeting and Financial Planning with Xero

Xero can be a powerful tool for managing your personal finances and achieving your financial goals. Its budgeting features allow you to create detailed budgets, track spending, and analyze your financial performance, empowering you to make informed decisions about your money.

Creating and Managing Budgets in Xero

Xero provides a simple and intuitive way to create and manage budgets. You can start by setting up budget categories that align with your spending habits and financial goals. These categories can include essentials like housing, utilities, and groceries, as well as discretionary spending such as entertainment, travel, and dining. To create a budget in Xero, you’ll need to:

- Navigate to the “Budgets” section in your Xero dashboard.

- Select “Create Budget” and choose a budget period, such as monthly or annually.

- Enter your budgeted amounts for each category.

- Save your budget.

Once you’ve created your budget, Xero will automatically track your spending against your budgeted amounts. This allows you to see how you’re doing at a glance and make adjustments as needed.

Setting Realistic Financial Goals and Tracking Progress, Using xero for personal finances

Setting realistic financial goals is crucial for staying motivated and achieving financial success. When setting goals, it’s important to consider your current financial situation, income, and expenses. Break down large goals into smaller, more achievable steps. Here are some tips for setting realistic financial goals:

- Start small: Begin with small, achievable goals that build momentum and confidence. For example, you could set a goal to save $100 per month for six months.

- Be specific: Define your goals clearly and quantifiably. Instead of saying “I want to save more,” say “I want to save $5,000 in the next year.”

- Set a timeline: Assign a deadline for achieving your goals. This creates a sense of urgency and helps you stay on track.

- Track your progress: Regularly monitor your progress towards your goals and celebrate milestones along the way.

Xero’s reporting features can help you track your progress towards your financial goals. You can create custom reports to view your income, expenses, and net worth over time. This data can provide valuable insights into your financial health and help you identify areas where you can improve.

Analyzing Budget Performance and Making Adjustments

Regularly analyzing your budget performance is essential for staying on track and making necessary adjustments. Xero provides a range of reporting tools to help you understand your spending patterns and identify areas where you can save money. You can use Xero’s reports to:

- Compare actual spending to budgeted amounts: This will help you identify areas where you’re overspending or underspending.

- Track your progress towards financial goals: This can help you stay motivated and make necessary adjustments to your budget.

- Identify trends in your spending: This can help you understand your spending habits and make informed decisions about your money.

Based on your analysis, you can make adjustments to your budget to better align with your financial goals. This might involve reducing spending in certain categories, increasing savings, or finding ways to increase your income.

Array

Xero understands the importance of protecting your financial data. They implement various security measures to ensure your personal information is safe and secure. This section will explore these measures and guide you on managing your account securely.

Security Measures Implemented by Xero

Xero employs multiple layers of security measures to safeguard your data. These measures include:

- Data Encryption: Xero encrypts all data in transit and at rest, meaning your data is protected both while being transmitted and stored on Xero’s servers.

- Secure Authentication: Xero utilizes two-factor authentication (2FA) to add an extra layer of security to your account. This requires you to enter a code from your phone or authenticator app in addition to your password when logging in.

- Regular Security Audits: Xero conducts regular security audits to identify and address any potential vulnerabilities in their systems. These audits help ensure that Xero’s security measures remain robust and effective.

- Compliance with Industry Standards: Xero adheres to industry standards for data security, such as ISO 27001, SOC 2, and PCI DSS. This demonstrates their commitment to maintaining a high level of security for your data.

Managing User Access and Permissions in Xero

You can control who has access to your Xero account and what they can do within it. This is crucial for maintaining the privacy and security of your financial information.

- User Roles and Permissions: Xero allows you to create different user roles with specific permissions. For example, you can create a user with read-only access to view transactions but not make changes. This allows you to share your account with others without compromising your financial security.

- Password Management: It’s essential to use strong passwords for your Xero account and avoid using the same password for multiple accounts. You should also regularly change your password to prevent unauthorized access.

Tips for Maintaining a Secure and Private Xero Account

Here are some tips to ensure your Xero account remains secure and private:

- Enable Two-Factor Authentication: As mentioned earlier, 2FA is a crucial security measure that adds an extra layer of protection to your account.

- Be Cautious of Phishing Attempts: Be wary of suspicious emails or links claiming to be from Xero. Never click on links or provide your login credentials in suspicious emails.

- Regularly Review User Permissions: Periodically review the permissions granted to each user in your Xero account to ensure they are still appropriate.

- Keep Your Software Updated: Xero regularly releases software updates to address security vulnerabilities. Ensure you update your Xero software to the latest version to maintain the highest level of security.

By embracing the capabilities of Xero, individuals can unlock a new level of financial organization and clarity. From effortlessly tracking income and expenses to setting realistic budgets and managing investments, Xero empowers you to take control of your financial future. As you delve into the features and functionalities discussed in this guide, you’ll discover how Xero can be your trusted companion on your journey toward achieving your financial goals.

Commonly Asked Questions

Is Xero free for personal use?

Xero offers a free 30-day trial for all users, after which you’ll need to choose a paid plan. The pricing varies depending on the features you require and the number of transactions you anticipate.

Can I use Xero on my mobile device?

Yes, Xero has a mobile app available for both iOS and Android devices, allowing you to access your accounts and manage your finances on the go.

How secure is Xero for personal finance data?

Xero employs robust security measures, including encryption and two-factor authentication, to protect user data. They also comply with industry standards and regulations to ensure the safety and privacy of your financial information.

Can I import data from other financial tools into Xero?

Yes, Xero allows you to import data from various sources, including bank statements and CSV files. You can also connect your bank accounts and credit cards for automated transaction updates.

Does Xero offer customer support for personal users?

Xero provides comprehensive customer support resources, including online help articles, FAQs, and a dedicated support team. You can contact them via phone, email, or live chat. (*)

Komentar