Suarapublik – Personal finance for physicians is a critical topic, given the unique financial challenges and opportunities that come with a career in medicine. Physicians face high educational debt, complex compensation structures, and significant income potential, making it essential to have a solid financial plan in place. This guide explores the key aspects of personal finance for physicians, from managing debt and building a strong foundation to investing for the future and planning for retirement.

Navigating the financial landscape as a physician requires a thoughtful approach that considers both short-term and long-term goals. This guide aims to empower physicians with the knowledge and tools needed to make informed financial decisions, achieve financial stability, and secure their financial future.

Array

As a physician, you have a unique set of financial needs and opportunities. Your income potential is high, but so are your expenses, and your career path can be unpredictable. Therefore, building a strong financial foundation is essential to achieving your financial goals and securing your future.

Creating a Comprehensive Financial Plan, Personal finance for physicians

A financial plan is a roadmap that Artikels your financial goals and the steps you need to take to achieve them. It should consider your income, expenses, assets, liabilities, and risk tolerance. A well-crafted financial plan for physicians should address key areas like retirement planning, savings, investments, debt management, and estate planning.

Sample Budget Template for Physicians

| Category | Average Monthly Expense |

|---|---|

| Housing | $2,000 – $5,000 |

| Transportation | $500 – $1,500 |

| Food | $500 – $1,000 |

| Healthcare | $200 – $500 |

| Childcare | $0 – $2,000 |

| Education | $0 – $1,000 |

| Entertainment | $200 – $500 |

| Savings | $1,000 – $5,000 |

| Debt Repayment | $0 – $2,000 |

| Other | $0 – $1,000 |

This is just a sample budget template, and your actual expenses may vary. It’s important to track your spending and adjust your budget accordingly.

Key Financial Goals for Physicians

- Retirement Planning: Physicians should start planning for retirement early to maximize their savings and investment growth. They can consider contributing to a 401(k) or 403(b) plan, which offers tax advantages.

- Savings: Establishing an emergency fund with 3-6 months of living expenses is crucial for unexpected events. Physicians should also prioritize saving for short-term goals like a down payment on a house or a child’s education.

- Investments: Investing in a diversified portfolio of stocks, bonds, and real estate can help physicians grow their wealth over the long term. They can consider working with a financial advisor to develop an investment strategy that aligns with their risk tolerance and financial goals.

Essential Financial Resources and Tools for Physicians

- Financial Advisor: A financial advisor can provide personalized advice and guidance on financial planning, investment strategies, and retirement planning.

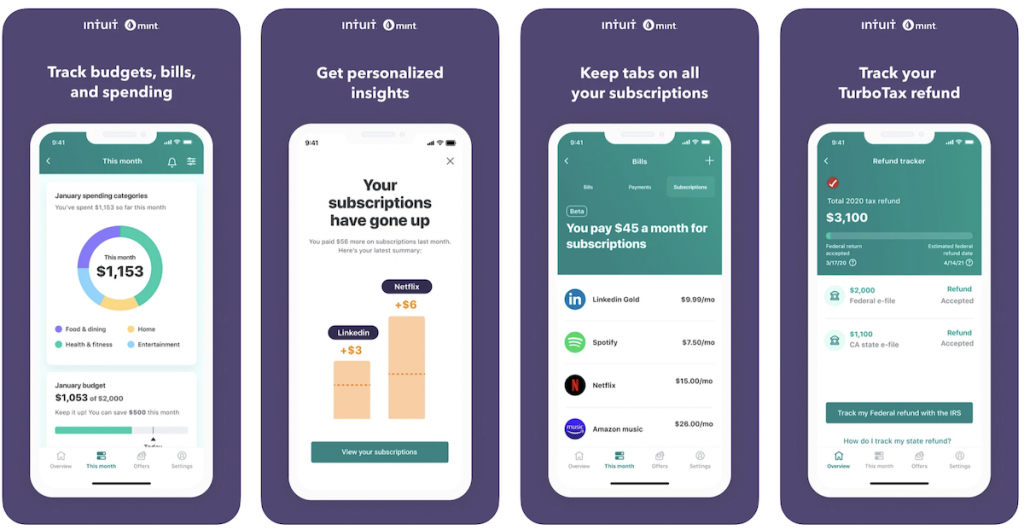

- Online Budgeting Tools: Tools like Mint or Personal Capital can help you track your spending, create a budget, and monitor your net worth.

- Financial Literacy Resources: Organizations like the Financial Planning Association and the National Endowment for Financial Education offer educational resources and tools for physicians.

- Professional Associations: Many medical associations offer financial planning resources and discounts on financial services for their members.

Understanding the nuances of personal finance for physicians is crucial for achieving financial success and living a fulfilling life. By implementing the strategies Artikeld in this guide, physicians can effectively manage their finances, optimize their income, invest wisely, and plan for a secure and prosperous future. Remember, taking control of your financial well-being is an investment in your present and your future.

Common Queries: Personal Finance For Physicians

How can physicians maximize their retirement savings?

Physicians can maximize their retirement savings by contributing the maximum amount allowed to tax-advantaged retirement accounts like 401(k)s and 403(b)s. They can also explore other options like Roth IRAs and traditional IRAs, depending on their financial situation and goals.

What are some common financial mistakes physicians make?

Common financial mistakes physicians make include failing to create a budget, overspending, neglecting to save for retirement, not investing wisely, and not seeking professional financial advice.

What are some essential financial resources for physicians?

Essential financial resources for physicians include financial advisors, certified public accountants (CPAs), and professional organizations that offer financial guidance and support.

How can physicians protect themselves from financial risks?

Physicians can protect themselves from financial risks by having adequate insurance coverage, including liability, disability, and life insurance. They should also consider diversifying their investments and seeking professional advice to manage their financial risks effectively.

Komentar