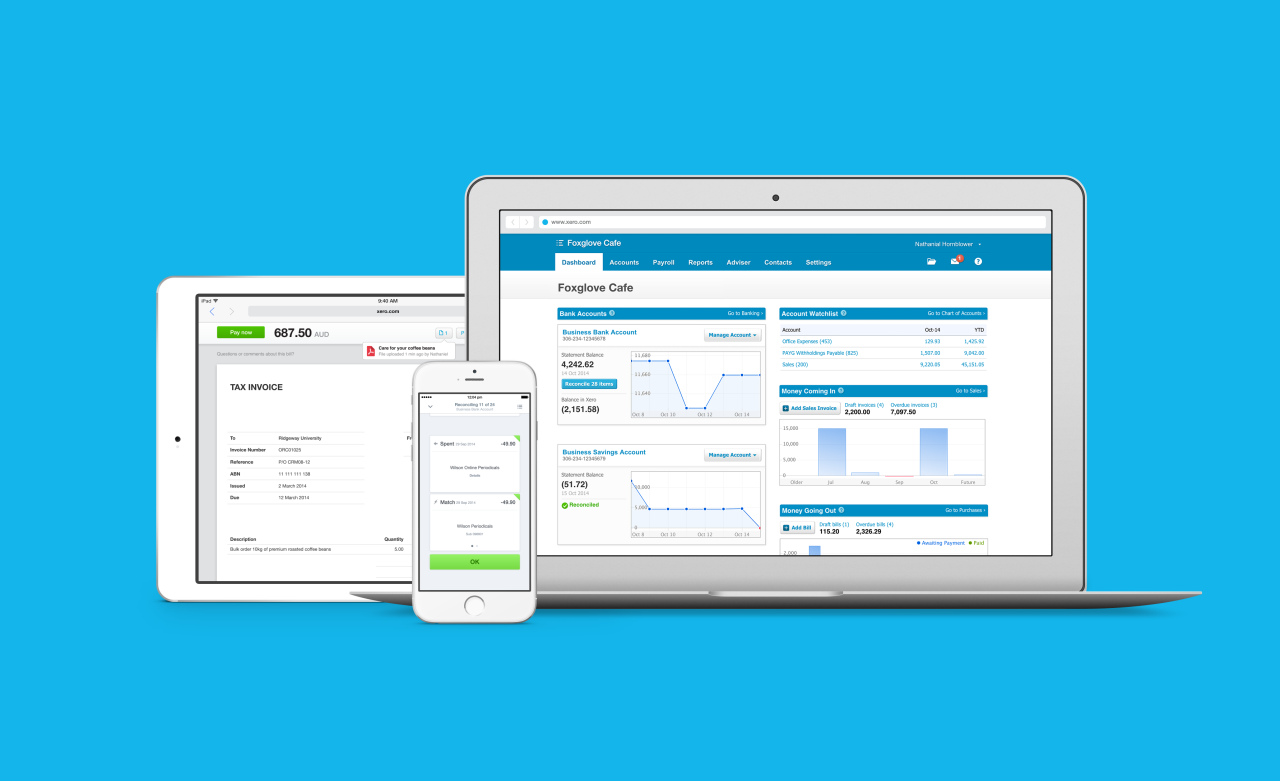

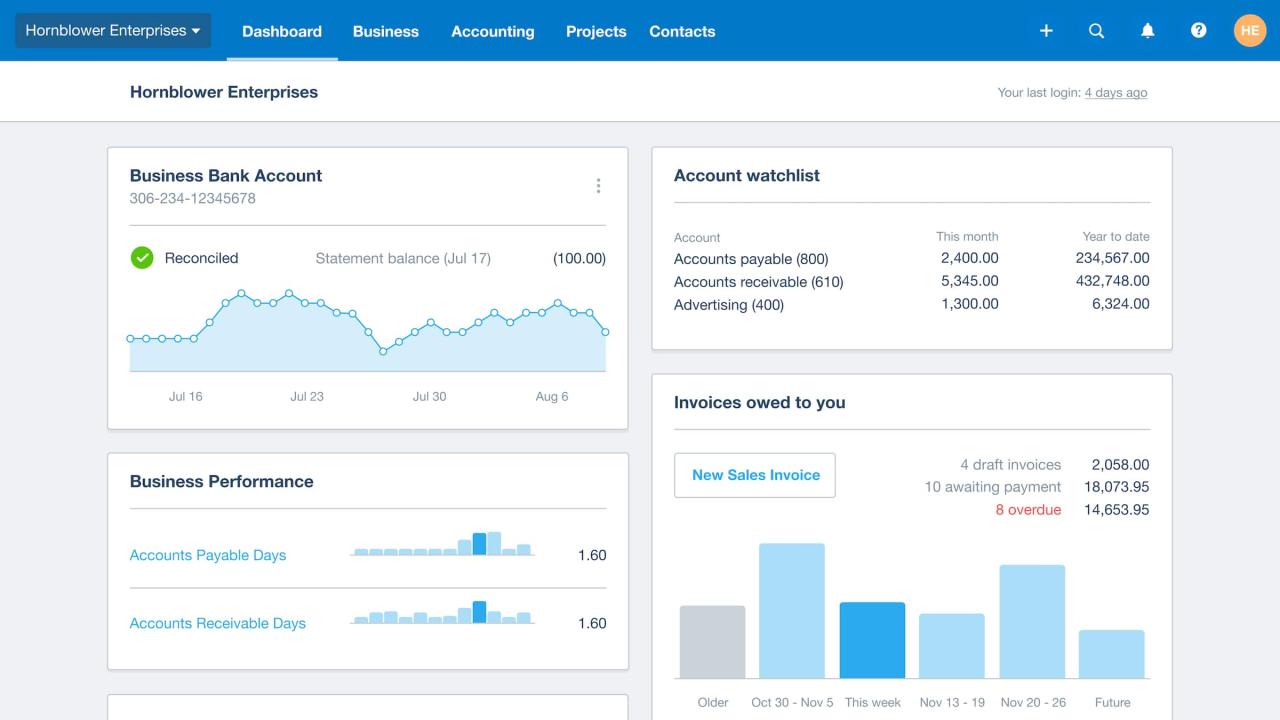

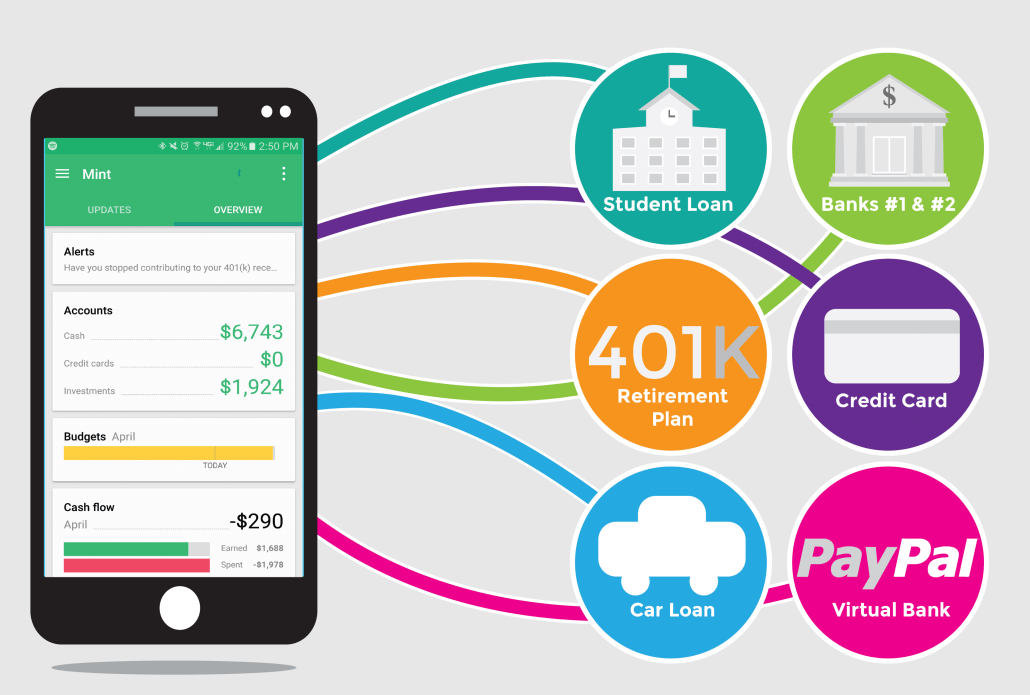

Suarapublik – Mint Personal Finance Safe is a powerful tool that empowers individuals to take control of their financial lives. It goes beyond simply tracking expenses and income; it actively helps users achieve their financial goals by providing valuable insights and actionable advice.

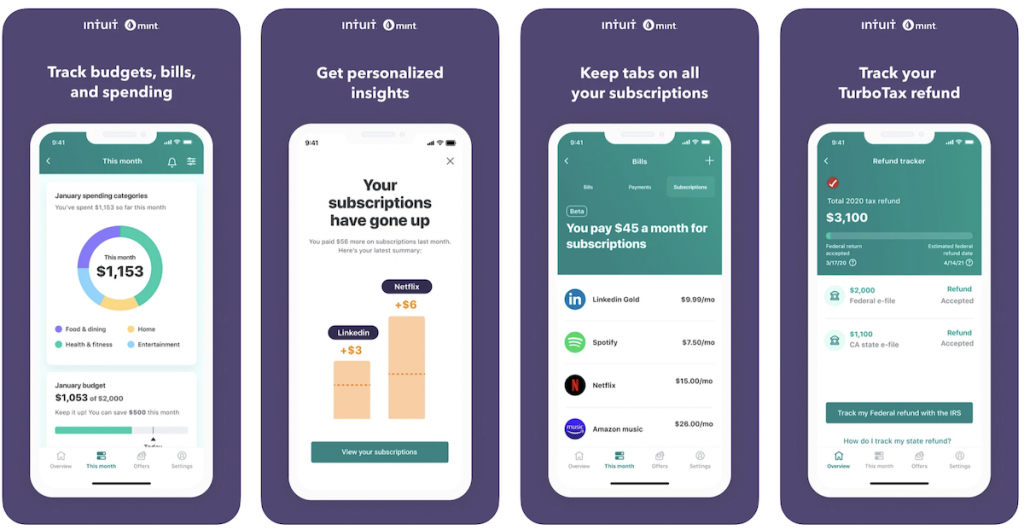

With its intuitive interface and comprehensive features, Mint makes managing your money easier than ever before. From budgeting and saving to investing and debt management, Mint offers a wide range of tools to help you navigate the complexities of personal finance. But beyond its functionality, Mint’s commitment to security is what truly sets it apart.

Mint’s Security Features

Mint, a popular personal finance management platform, prioritizes the security of its users’ financial data. It implements a comprehensive set of measures to protect against unauthorized access and data breaches.

Security Measures

Mint employs a multi-layered approach to security, encompassing encryption, authentication, and regular security audits. These measures are designed to safeguard user data at every stage of its lifecycle.

- Data Encryption: Mint encrypts all sensitive user data, including financial information, passwords, and transaction details, both in transit and at rest. This ensures that even if data is intercepted, it remains unreadable without the appropriate decryption key.

- Two-Factor Authentication (2FA): Mint offers 2FA as an extra layer of security. When enabled, users are required to provide an additional code, usually generated by a mobile app or sent via SMS, in addition to their password during login. This makes it significantly harder for unauthorized individuals to access accounts, even if they obtain a user’s password.

- Regular Security Audits: Mint conducts regular security audits to identify and address potential vulnerabilities. These audits are performed by independent security experts and involve thorough assessments of Mint’s systems, applications, and infrastructure. By proactively identifying and addressing vulnerabilities, Mint aims to maintain a robust security posture.

Safeguarding Against Unauthorized Access

Mint implements various measures to prevent unauthorized access to user data. These measures include access controls, user authentication, and robust infrastructure security.

- Access Controls: Mint uses role-based access control (RBAC) to restrict access to sensitive data based on user roles and permissions. This ensures that only authorized personnel can access specific information. For example, customer support representatives may have access to basic account information but not to sensitive financial details.

- User Authentication: Mint uses strong password policies and multi-factor authentication to verify user identities. Users are required to create complex passwords and can choose to enable 2FA for additional security. This helps prevent unauthorized access to accounts.

- Infrastructure Security: Mint maintains a secure infrastructure with firewalls, intrusion detection systems (IDS), and other security measures to protect against external threats. This includes regular updates and patches to address vulnerabilities and protect against malware and other malicious attacks.

Comparison with Other Personal Finance Platforms

Mint’s security practices are generally considered to be in line with or exceed those of other leading personal finance platforms. Many platforms implement similar security measures, such as encryption, 2FA, and regular security audits. However, Mint’s commitment to security and its proactive approach to vulnerability management have earned it a reputation for strong security practices.

Mint’s Data Privacy and Security

Mint, like any other financial service provider, takes data privacy seriously. They have a comprehensive set of policies and practices in place to safeguard your financial information.

Mint’s Data Privacy Policies

Mint’s privacy policy Artikels how they collect, use, share, and protect your personal information. It covers various aspects, including data collection practices, data security measures, and your rights regarding your data.

- Data Collection: Mint collects information directly from you when you sign up for an account, as well as indirectly from your financial institutions when you link your accounts. This information includes your name, address, email address, financial account details, and transaction history.

- Data Usage: Mint uses your data to provide you with personalized financial insights, budgeting tools, and financial management features. They also use your data to improve their services, develop new features, and for marketing purposes.

- Data Sharing: Mint may share your data with third-party service providers who help them operate their business. These providers are bound by confidentiality agreements and are prohibited from using your data for any other purpose. Mint may also share your data with law enforcement or regulatory agencies if required by law.

- Data Security: Mint employs various security measures to protect your data from unauthorized access, use, disclosure, alteration, or destruction. These measures include encryption, firewalls, and access controls.

Data Handling and Compliance

Mint adheres to industry best practices and complies with relevant regulations, such as the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA). They have a dedicated team responsible for data privacy and security, who regularly review and update their policies and practices.

Opting Out of Data Sharing and Managing Privacy Settings

You have the right to opt out of certain data sharing practices within Mint. You can manage your privacy settings by accessing your account settings and adjusting your preferences. This includes controlling how your data is used for marketing purposes and managing the sharing of your information with third parties.

Mint’s privacy policy states: “You have the right to access, correct, delete, or restrict the processing of your personal data. You also have the right to object to the processing of your data, and the right to data portability.”

Using Mint Safely

Mint is a powerful tool for managing your finances, but like any online service, it’s important to use it safely. By following a few simple best practices, you can protect your information and ensure that your Mint account remains secure.

Strong Passwords

Creating strong passwords is essential for protecting your online accounts. A strong password is at least 12 characters long, and includes a combination of uppercase and lowercase letters, numbers, and symbols. For example, “MyP@sswOrd123” is a stronger password than “password123”.

- Avoid using personal information: Don’t use your name, birthday, or address in your password.

- Don’t reuse passwords: Use a different password for each of your online accounts. This way, if one account is compromised, your other accounts will be safe.

- Use a password manager: A password manager can help you create and store strong, unique passwords for all of your online accounts.

Two-Factor Authentication, Mint personal finance safe

Two-factor authentication (2FA) adds an extra layer of security to your account by requiring you to enter a code from your phone or email in addition to your password. This makes it much harder for unauthorized users to access your account, even if they know your password.

- Enable 2FA: Mint offers 2FA as a security option. You can enable it by going to your account settings.

- Use a secure method: Choose a 2FA method that is secure and convenient for you, such as an authenticator app or a text message.

- Don’t share your codes: Never share your 2FA codes with anyone, even if they claim to be from Mint.

Regularly Monitoring Accounts

It’s important to regularly monitor your Mint account for any suspicious activity. This includes checking your transactions, account balances, and security settings.

- Review your transactions: Look for any transactions that you don’t recognize. If you see something suspicious, contact your bank or credit card company immediately.

- Check your account balances: Make sure that your account balances are correct. If you see any discrepancies, contact your financial institution.

- Review your security settings: Make sure that your security settings are up-to-date. If you’ve made any changes to your password or 2FA, update your settings in Mint.

Reporting Suspicious Activity

If you notice any suspicious activity in your Mint account, it’s important to report it immediately. This will help protect your account and prevent further unauthorized access.

- Contact Mint support: If you see any suspicious activity, contact Mint support immediately. They can help you investigate the issue and take steps to secure your account.

- Report the activity to your financial institutions: If you see any unauthorized transactions, report them to your bank or credit card company.

- Change your password: If you think your account may have been compromised, change your password immediately.

Mint’s Role in Financial Security: Mint Personal Finance Safe

Mint plays a crucial role in enhancing your financial security by providing a comprehensive overview of your finances and empowering you to make informed decisions. It helps you stay on top of your spending, identify potential risks, and take proactive steps to protect your financial well-being.

Identifying Potential Financial Risks

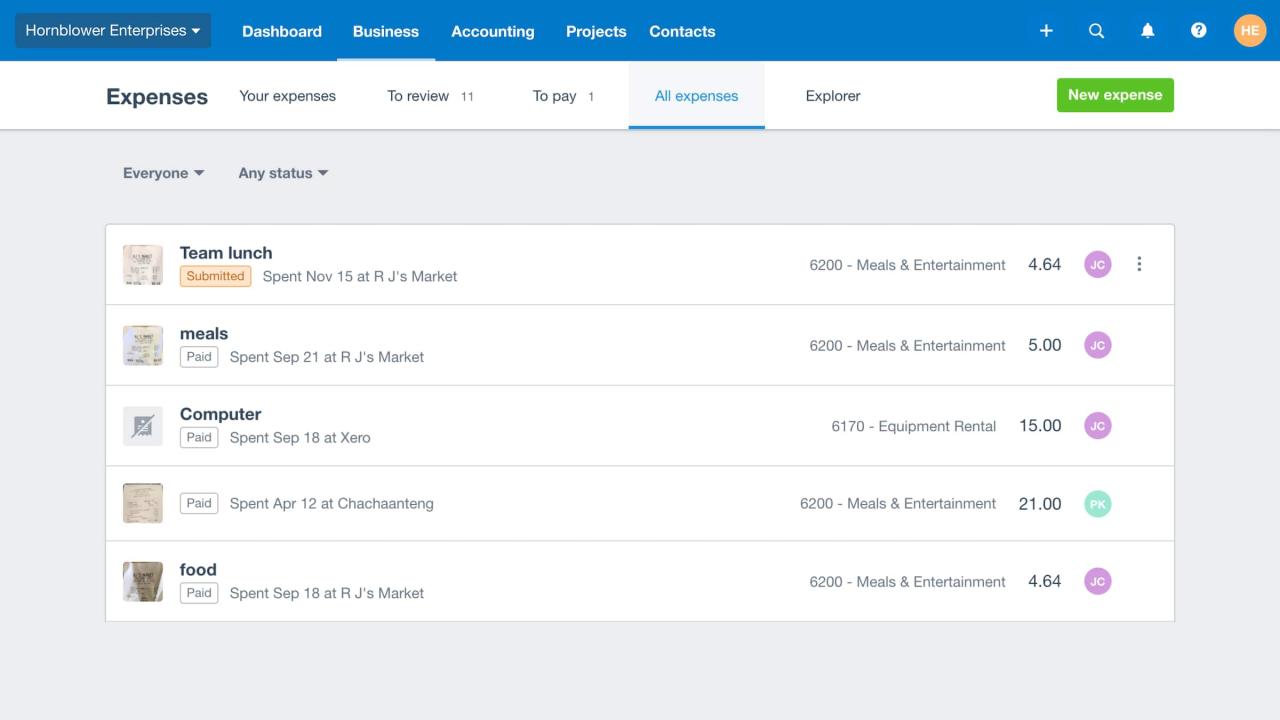

Mint’s tools can help you identify potential financial risks by providing insights into your spending patterns, debt levels, and overall financial health. For instance, Mint can:

- Alert you to potential overspending: By tracking your spending, Mint can identify if you’re exceeding your budget in certain categories, potentially leading to debt accumulation.

- Highlight high-interest debt: Mint can analyze your debt and identify loans with high-interest rates, which can significantly impact your financial security. This allows you to prioritize paying off these debts and save money on interest charges.

- Monitor your credit score: Mint provides access to your credit score and reports, allowing you to track your credit health and identify any potential issues that could affect your borrowing power.

Empowering Informed Financial Decisions

Mint empowers you to make informed financial decisions by providing valuable insights and tools to help you manage your money effectively. For example, Mint can:

- Create and track budgets: Mint allows you to set personalized budgets and track your spending against them, helping you stay on top of your finances and avoid overspending.

- Identify potential savings opportunities: Mint can analyze your spending and identify areas where you might be able to save money, such as by switching to a lower-cost credit card or negotiating better rates on your bills.

- Provide personalized financial advice: Mint offers personalized financial advice based on your individual circumstances and goals, helping you make informed decisions about investing, saving, and managing your money.

Array

Mint, as a leading personal finance management platform, is constantly evolving to meet the ever-changing demands of online financial security. The platform’s future lies in proactively adapting to emerging threats and implementing cutting-edge technologies to safeguard user data and transactions.

Advancements in Security Features and Data Privacy Practices

Mint is poised to further enhance its security features and data privacy practices by leveraging advancements in technology and industry best practices. These advancements will contribute to a more robust and secure platform for users.

- Enhanced Authentication: Implementing multi-factor authentication (MFA) with biometrics and other advanced authentication methods will strengthen account security and make it more difficult for unauthorized access.

- Advanced Fraud Detection: Utilizing machine learning and artificial intelligence (AI) algorithms can significantly improve fraud detection capabilities, proactively identifying and preventing suspicious activities.

- Data Encryption and Secure Storage: Implementing end-to-end encryption for all user data and storing it in secure, geographically dispersed data centers will minimize the risk of data breaches and unauthorized access.

- Regular Security Audits and Vulnerability Assessments: Conducting regular security audits and vulnerability assessments will ensure that Mint’s systems are constantly evaluated for potential weaknesses and vulnerabilities, leading to timely remediation and improved security posture.

Adapting to the Evolving Landscape of Online Financial Security

The online financial landscape is constantly evolving, with new threats emerging regularly. Mint’s future success depends on its ability to adapt to these changes and stay ahead of the curve in terms of security.

- Emerging Threat Mitigation: Mint needs to proactively monitor and adapt to emerging threats, such as sophisticated phishing attacks, social engineering schemes, and new malware variations, to protect users from these evolving risks.

- Compliance with Data Privacy Regulations: Staying compliant with evolving data privacy regulations, such as GDPR and CCPA, is crucial for maintaining user trust and ensuring responsible data handling practices.

- Collaboration with Financial Institutions: Strengthening partnerships with financial institutions to share information and best practices on security threats and vulnerabilities will enable Mint to better protect its users.

Enhancing User Trust and Confidence

Building and maintaining user trust is paramount for any financial platform. Mint can further enhance user trust and confidence through transparent communication, proactive security measures, and user education.

- Transparent Security Practices: Regularly publishing security reports and updates on implemented security measures will demonstrate Mint’s commitment to transparency and accountability, fostering trust among users.

- User Education and Awareness: Providing users with educational resources and guides on online financial security best practices will empower them to protect themselves from common threats and make informed decisions about their online financial activities.

- Prompt Response to Security Incidents: In the event of a security incident, Mint needs to respond promptly and transparently, providing clear communication to affected users and outlining steps taken to mitigate the impact.

In today’s digital world, protecting your financial information is more important than ever. Mint Personal Finance Safe provides a secure platform for managing your money, offering peace of mind knowing that your data is protected with the latest security measures. By embracing Mint’s security features and following best practices for online financial security, you can confidently navigate the world of personal finance and achieve your financial goals with peace of mind.

Question & Answer Hub

Is Mint safe to use?

Yes, Mint employs robust security measures to protect user data. These include encryption, two-factor authentication, and regular security audits.

What happens if my Mint account is compromised?

Mint offers various security features to help prevent unauthorized access, including password protection and two-factor authentication. If you suspect your account has been compromised, you should immediately contact Mint support for assistance.

How can I be sure that my data is protected?

Mint is committed to protecting user privacy and complies with relevant data privacy regulations. They have clear data privacy policies outlining how they handle user information.

What are the benefits of using Mint?

Mint offers numerous benefits, including budgeting tools, expense tracking, debt management, investment tracking, and personalized financial advice. (red**)