Suarapublik – Separate business and personal finances is essential for success and financial stability. It creates a clear distinction between your personal life and your business ventures, allowing you to manage both effectively. This separation not only simplifies accounting and tax preparation but also protects your personal assets from business liabilities.

By establishing separate bank accounts, creating detailed financial records, and developing a comprehensive budgeting system, you can gain control over your finances and make informed decisions. This approach also helps you to avoid common pitfalls, such as commingling funds, which can lead to confusion and potential legal issues.

Managing Finances Effectively: Separate Business And Personal Finances

Managing your finances effectively is crucial for both your business and personal life. It allows you to make informed decisions, achieve financial goals, and avoid unnecessary financial stress. By implementing a system for tracking income and expenses, organizing your financial records, and creating a budget, you can gain control over your finances and build a solid financial foundation.

Tracking Business Income and Expenses

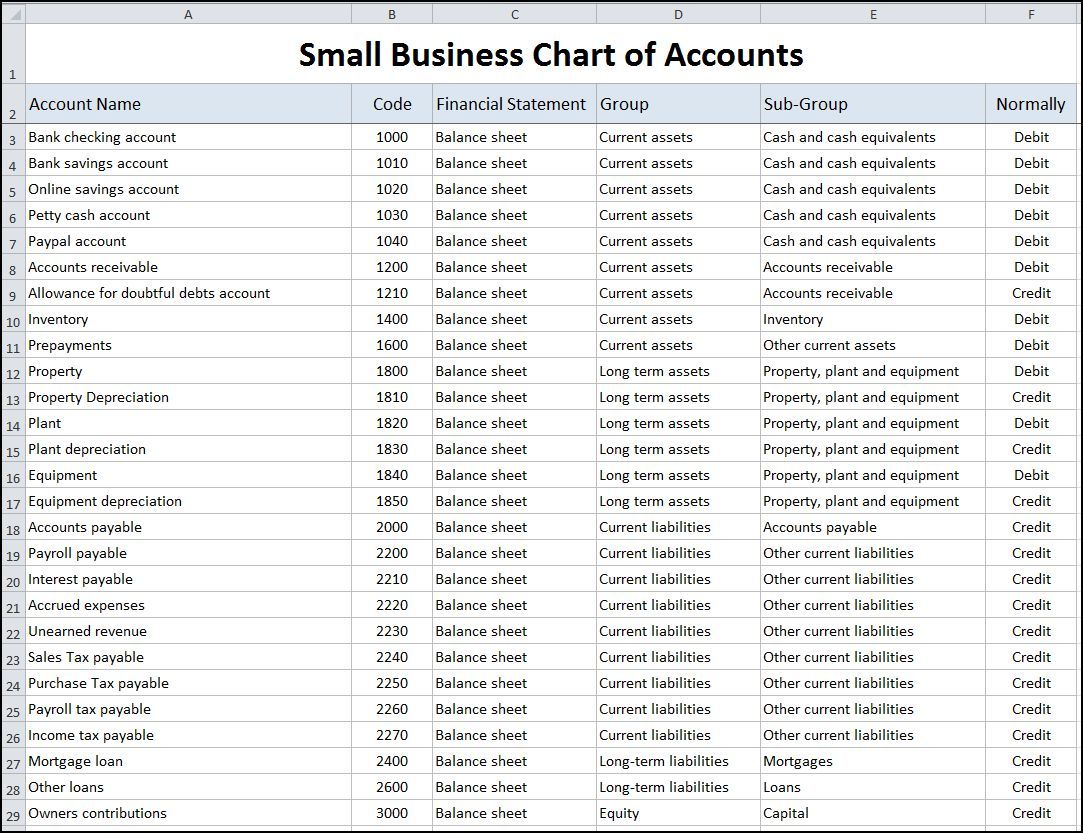

Tracking business income and expenses is essential for understanding your business’s financial health. It helps you identify areas of profitability, monitor cash flow, and make informed decisions about pricing, spending, and investments.Here are some methods for tracking business income and expenses:

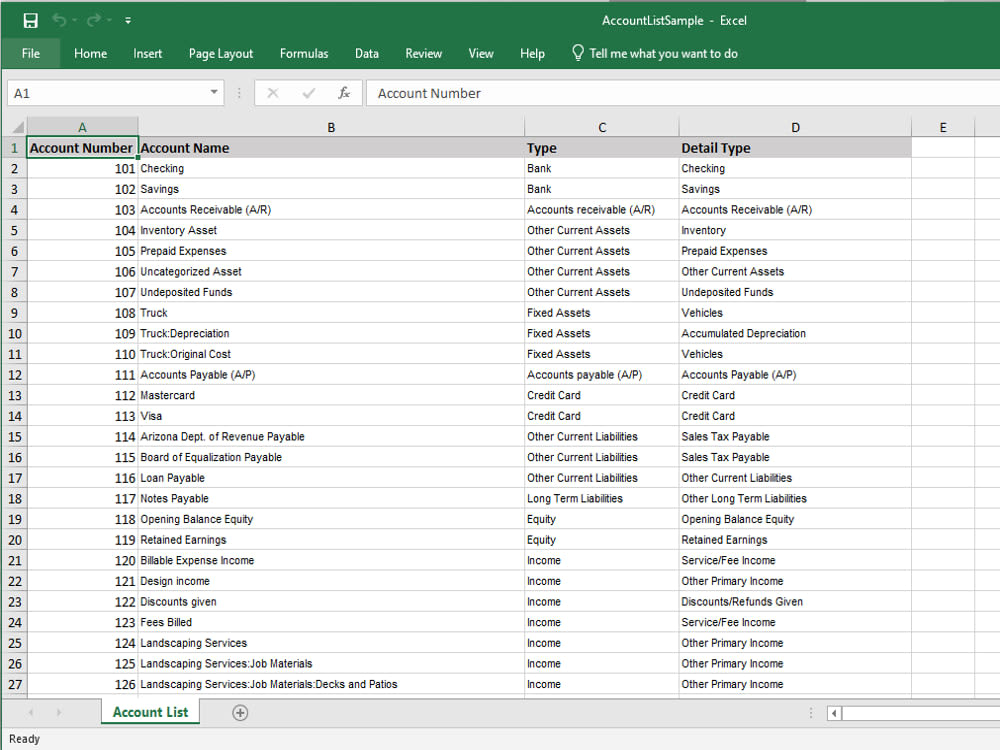

- Spreadsheet Software: Spreadsheets are a versatile tool for tracking income and expenses. You can create custom formulas to calculate totals, track trends, and generate reports. Popular spreadsheet software includes Microsoft Excel, Google Sheets, and OpenOffice Calc.

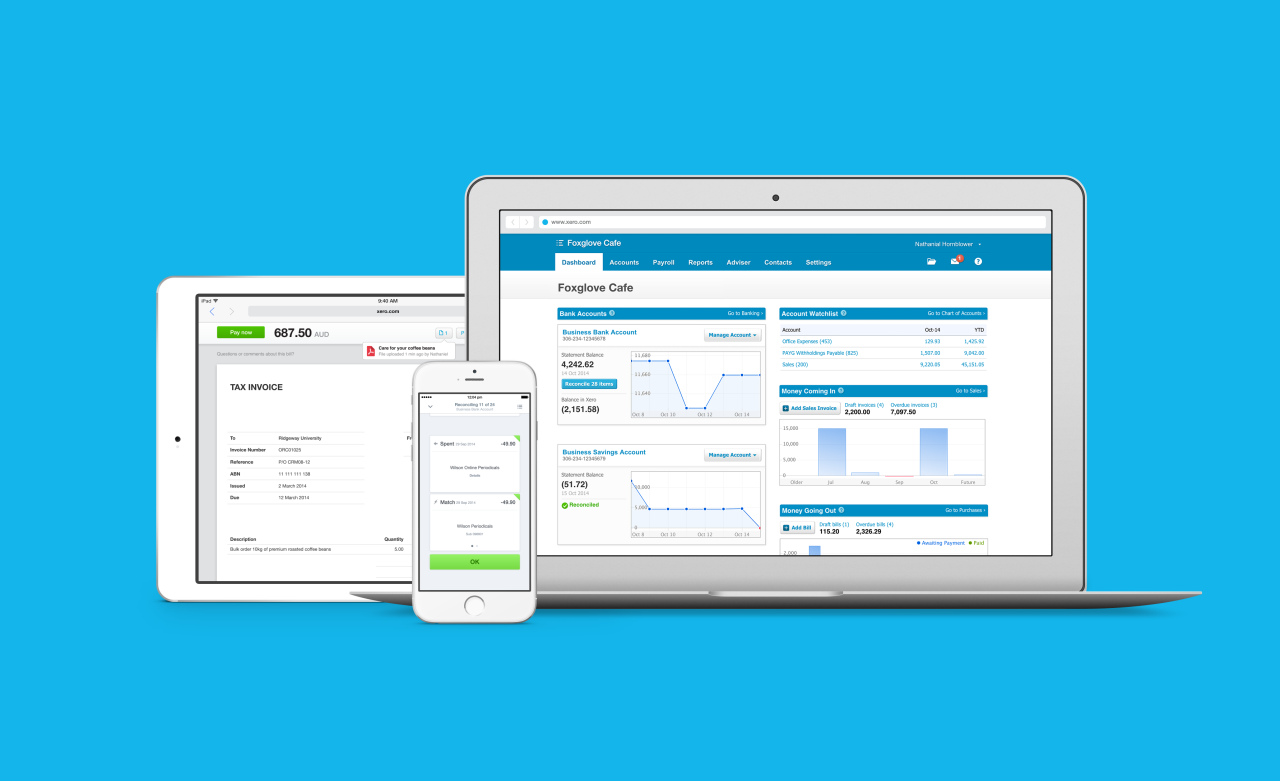

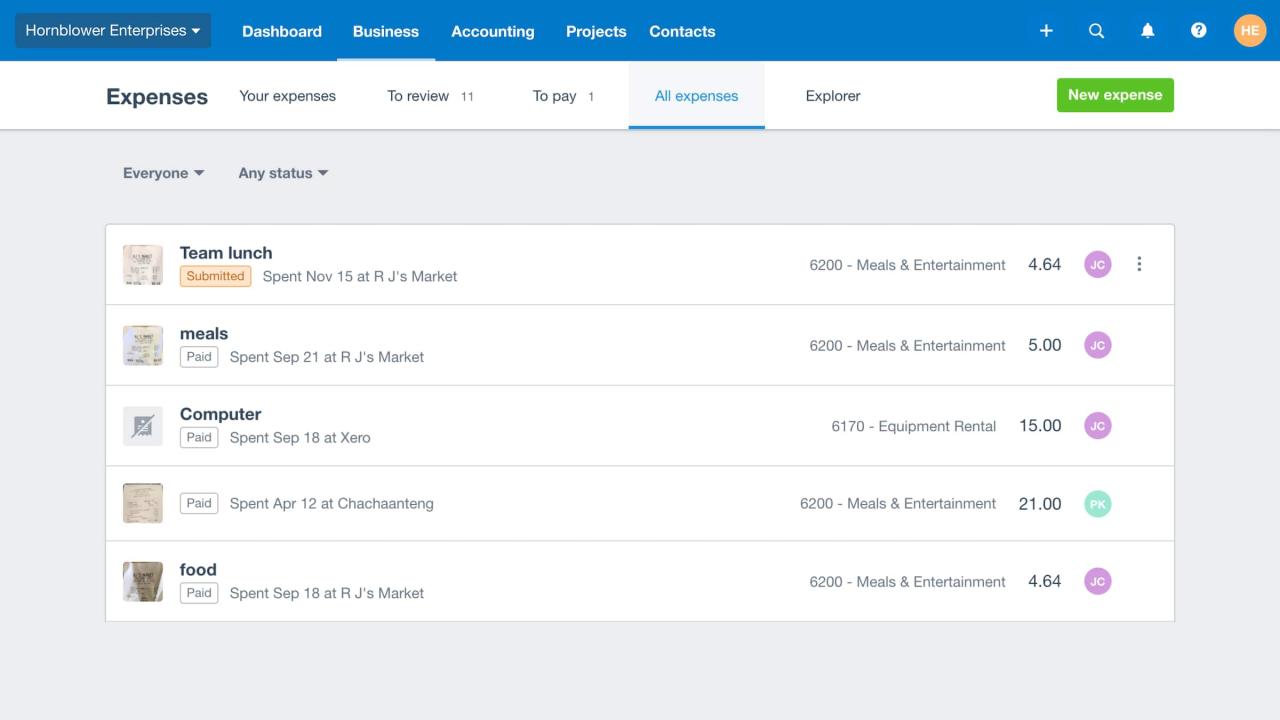

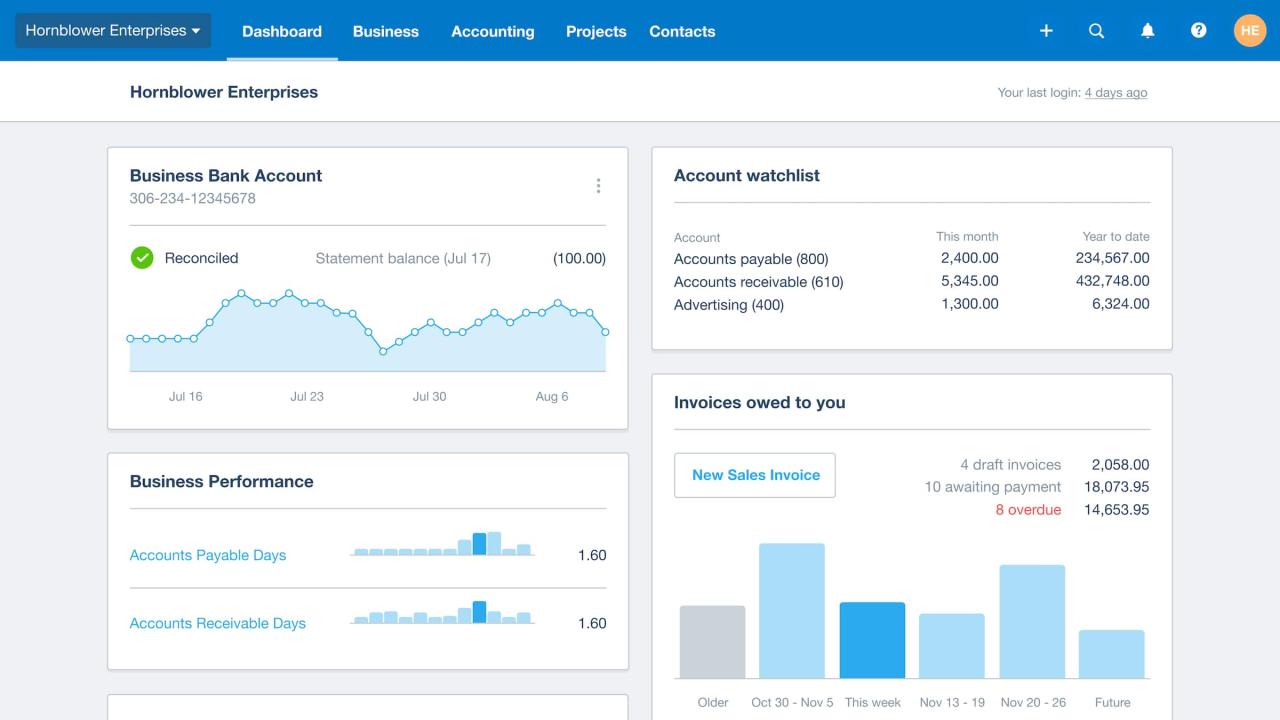

- Accounting Software: Accounting software provides a more comprehensive approach to managing business finances. It offers features such as invoicing, expense tracking, bank reconciliation, and financial reporting. Some popular accounting software options include QuickBooks, Xero, and FreshBooks.

- Manual Tracking: While less efficient, manual tracking can be effective for small businesses with low transaction volumes. You can use notebooks, journals, or spreadsheets to record income and expenses.

Tax Implications

Separating your business and personal finances offers significant advantages when it comes to tax preparation. By keeping these aspects distinct, you can streamline the process, potentially reduce your tax liability, and avoid potential penalties.

Tax Deductions for Businesses and Individuals

Keeping separate financial records allows for clear identification of business expenses and personal expenditures. This simplifies the process of claiming eligible tax deductions.

- Business Expenses: Businesses can deduct a wide range of expenses directly related to their operations, including rent, utilities, supplies, marketing costs, and employee salaries.

- Individual Expenses: Individuals can claim deductions for various expenses, including mortgage interest, property taxes, charitable donations, and medical expenses.

Maximizing Tax Benefits with Organized Records

Maintaining well-organized financial records is crucial for maximizing tax benefits. This involves keeping receipts, invoices, bank statements, and other relevant documents in a structured manner.

“A well-organized system ensures that you can quickly access necessary information when filing your taxes, reducing the risk of missing out on eligible deductions.”

- Digital Accounting Software: Using accounting software can automate record-keeping, making it easier to track expenses, categorize transactions, and generate reports.

- Cloud-Based Storage: Storing your financial documents in the cloud provides secure access from any device and facilitates easy sharing with tax professionals.

- Regular Review: Periodically reviewing your financial records ensures accuracy and helps identify any potential issues or discrepancies.

Tools and Resources

Managing separate finances for your business and personal life can be simplified with the right tools and resources. This section will provide you with a list of useful software and apps, resources for finding financial professionals, and the benefits of using online banking platforms for both your business and personal finances.

Financial Software and Apps, Separate business and personal finances

Financial software and apps can help you manage your finances, track spending, create budgets, and set financial goals.

- Personal Finance Software: Popular personal finance software options include Mint, Personal Capital, and YNAB (You Need a Budget). These platforms allow you to connect your bank accounts, credit cards, and investment accounts to track your spending and income in one place. They can also help you create budgets, set financial goals, and monitor your progress.

- Business Accounting Software: For business finances, you can use accounting software like QuickBooks, Xero, and FreshBooks. These platforms provide features for tracking income and expenses, generating invoices, managing payroll, and preparing tax reports. They often integrate with online banking platforms for easy account reconciliation.

- Mobile Apps: Many financial software companies also offer mobile apps that allow you to access your accounts and manage your finances on the go. Mobile apps provide convenience and flexibility, allowing you to monitor your spending, make payments, and transfer funds from anywhere with an internet connection.

Finding Accounting Professionals and Financial Advisors

- Professional Organizations: Organizations like the American Institute of Certified Public Accountants (AICPA) and the National Association of Certified Valuation Analysts (NACVA) can provide directories of certified accounting professionals in your area. You can also find qualified financial advisors through organizations like the Certified Financial Planner Board of Standards (CFP Board) or the National Association of Personal Financial Advisors (NAPFA).

- Referrals: Seek recommendations from trusted friends, family, or business associates. Ask for referrals from other business owners or professionals you admire.

- Online Platforms: Websites like NerdWallet, Bankrate, and Investopedia provide resources for finding financial advisors, including reviews and comparisons of different professionals.

Online Banking Platforms

Online banking platforms offer a convenient way to manage both your business and personal finances.

- Account Management: You can access your accounts, view transaction history, and monitor balances anytime, anywhere.

- Bill Pay: Online banking allows you to schedule bill payments, set reminders, and track payment confirmations.

- Transfer Funds: Transfer money between accounts easily and securely.

- Security: Reputable online banking platforms use advanced security measures to protect your financial information.

- Mobile Access: Most online banking platforms have mobile apps that provide access to your accounts from your smartphone or tablet.

Array

It’s crucial to be aware of common pitfalls when managing separate finances to avoid potential financial distress and maintain a healthy financial life. Understanding these mistakes and implementing preventive measures can significantly enhance your financial well-being.

Mixing Personal and Business Expenses

Mixing personal and business expenses can lead to inaccurate financial records, making it challenging to track profitability, claim legitimate tax deductions, and manage your personal finances effectively.

- Inaccurate Financial Records: When personal and business expenses are mixed, it becomes difficult to distinguish between them, leading to inaccurate financial records. This makes it challenging to track your business’s profitability, analyze spending patterns, and make informed financial decisions.

- Missed Tax Deductions: Business expenses are often deductible for tax purposes. Mixing personal and business expenses can result in missing out on these deductions, increasing your tax liability.

- Personal Financial Strain: Mixing expenses can lead to personal financial strain. If you’re using personal funds to cover business expenses, it can create a financial imbalance, potentially impacting your ability to meet personal financial obligations.

How to Avoid:* Use separate bank accounts for personal and business finances.

- Track all expenses meticulously, clearly labeling them as personal or business.

- Employ accounting software to automate expense tracking and reporting.

- Consult a financial advisor or accountant for guidance on tax deductions and financial management.

Not Saving Enough for Business Emergencies

Not having a dedicated emergency fund for your business can lead to significant financial challenges when unexpected expenses arise, potentially hindering growth and stability.

- Financial Instability: Without an emergency fund, unexpected events like equipment failure, legal issues, or market downturns can lead to financial instability, jeopardizing your business’s operations and survival.

- Borrowing at High Interest Rates: When facing unexpected expenses without a dedicated emergency fund, businesses often resort to high-interest loans, increasing financial burdens and potentially hindering long-term growth.

- Delayed Growth: A lack of an emergency fund can force businesses to delay growth opportunities due to financial constraints, limiting expansion and potentially missing out on crucial market opportunities.

How to Avoid:* Establish a separate business emergency fund.

- Aim to save at least 3-6 months of operating expenses.

- Consider using a dedicated savings account or a high-yield savings account to maximize returns.

- Develop a business contingency plan to address potential financial emergencies.

Ignoring Financial Planning

Neglecting financial planning can lead to poor decision-making, inadequate financial management, and potentially missed opportunities for growth and wealth creation.

- Poor Financial Decisions: Without a clear financial plan, businesses may make impulsive decisions based on short-term gains, leading to financial instability and potentially long-term consequences.

- Inadequate Financial Management: A lack of financial planning can result in inadequate financial management, including insufficient budgeting, poor cash flow management, and inadequate risk assessment, potentially hindering business growth and profitability.

- Missed Opportunities: Financial planning allows businesses to identify and capitalize on growth opportunities. Without a plan, businesses may miss out on strategic investments, acquisitions, or expansion opportunities.

How to Avoid:* Create a comprehensive business financial plan that Artikels goals, strategies, and financial projections.

- Regularly review and update your financial plan to reflect changes in the market and business environment.

- Consult with a financial advisor or accountant to develop a tailored financial plan that aligns with your business objectives.

Not Investing Wisely

Investing is a crucial aspect of business growth and financial security, but neglecting proper research and diversification can lead to significant financial losses and hinder long-term success.

- Financial Losses: Investing in high-risk ventures without adequate research and diversification can lead to substantial financial losses, potentially jeopardizing your business’s financial stability.

- Missed Growth Opportunities: Investing in low-risk, low-return assets can hinder your business’s growth potential. Diversifying your investment portfolio allows you to capitalize on different market sectors and potentially achieve higher returns.

- Lack of Financial Security: A poorly diversified investment portfolio can leave your business vulnerable to market fluctuations, potentially impacting your financial security and long-term sustainability.

How to Avoid:* Conduct thorough research before making any investment decisions.

- Diversify your investment portfolio across different asset classes, such as stocks, bonds, and real estate.

- Consult with a financial advisor or investment professional to develop a tailored investment strategy that aligns with your risk tolerance and financial goals.

In conclusion, maintaining separate business and personal finances is a fundamental aspect of responsible financial management. It fosters clarity, accountability, and ultimately contributes to the long-term success of your business and personal life. By embracing this practice, you can navigate the complexities of financial obligations with confidence and peace of mind.

FAQs

What are the main benefits of separating business and personal finances?

Separating finances offers several benefits, including: simplified accounting, accurate tax reporting, protection of personal assets, improved financial planning, and a clearer understanding of your financial position.

How do I choose the right bank accounts for my business and personal finances?

The best bank accounts depend on your specific needs. For business accounts, consider features like online banking, credit lines, and merchant services. For personal accounts, focus on interest rates, fees, and convenient access.

What are some common mistakes to avoid when managing separate finances?

Common mistakes include: commingling funds, neglecting to track expenses, failing to create a budget, and neglecting to seek professional advice when needed.